Offshore Company Formation Fundamentals Explained

Table of ContentsRumored Buzz on Offshore Company FormationOffshore Company Formation Can Be Fun For AnyoneRumored Buzz on Offshore Company FormationFascination About Offshore Company FormationOffshore Company Formation Can Be Fun For EveryoneOffshore Company Formation Things To Know Before You Buy

There are typically fewer lawful responsibilities of administrators of an offshore firm. It is likewise commonly very easy to set up an offshore business and also the procedure is less complex contrasted to having an onshore firm in several components of the globe.If you are a business person, for instance, you can produce an overseas company for privacy objectives and for simplicity of management. An offshore business can additionally be utilized to lug out a consultancy company.

Offshore Company Formation for Dummies

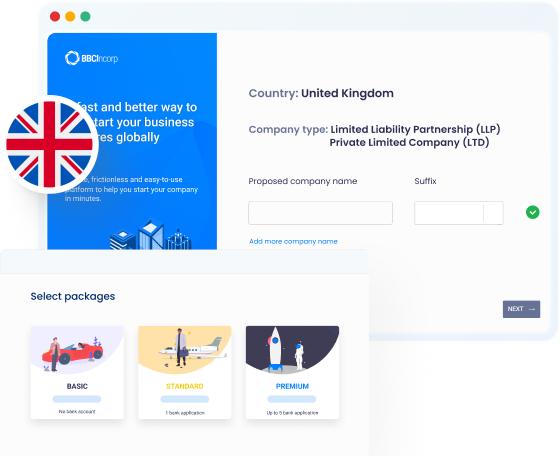

The process can take as little as 15 mins. Even before creating an overseas company, it is first vital to recognize why you choose offshore business formation to setting up an onshore business.

If your main goal for opening up an offshore company is for privacy functions, you can conceal your names using nominee solutions. With nominee solutions, one more individual takes up your duty and indications documents in your place. This suggests that your identification will certainly remain personal. There are numerous things that you must keep in mind when selecting an overseas territory.

Getting My Offshore Company Formation To Work

There are fairly a number of offshore territories and also the entire task of thinking of the most effective one can be quite made complex. There are a variety of things that you additionally need to place right into consideration when picking an overseas jurisdiction. Each area has its own distinct benefits. A few of the things that you need to consider include your residency scenario, your business and also your banking needs.

If you established an overseas firm in Hong Kong, you can trade globally without paying any type of local tax obligations; the only problem is that you need to not have a source of income from Hong Kong. There are no taxes on funding gains as well as financial investment earnings. The location is likewise politically and financially stable. offshore company formation.

With a lot of jurisdictions to select from, you can always find the most effective place to establish your overseas company. It is, nevertheless, vital to pay attention to details when developing your option as not all firms will permit you to open for checking account and you need to guarantee you practice proper home tax obligation planning for your regional along with the foreign territory.

Get This Report on Offshore Company Formation

Corporate structuring and planning have actually attained higher degrees of intricacy than in the past while the requirement for anonymity remains solid. Corporations must keep up and also be frequently looking for new ways to make money. One method is to have a clear understanding of the attributes of overseas international firms, as well as just how they may be placed to beneficial use.

A more right term a knockout post to use would certainly be tax obligation mitigation or planning, since there are ways of mitigating tax obligations without damaging the law, whereas tax evasion is generally categorized as a criminal activity. Yes, due to the fact that many countries urge international trade as well as business, so there are typically no limitations on locals doing organization or having savings account in other countries.

Not known Incorrect Statements About Offshore Company Formation

Innovative and also respectable high-net-worth people and also corporations consistently use offshore financial investment cars worldwide. Shielding possessions in mix with a Count on, an offshore company can avoid high degrees of revenue, funding as well as fatality taxes that would otherwise be payable if the assets were held directly. It can also secure properties from creditors and also various other interested celebrations.

If the business shares are held by a Count on, the ownership is lawfully vested in the trustee, therefore gaining the capacity for also better tax obligation preparation benefits. Family and Safety Trusts (perhaps as an option to a Will) for build-up of financial investment earnings and also long-term benefits for recipients on a positive tax basis (without earnings, inheritance or funding gains taxes); The sale or probate of properties in various countries can end up being complex and pricey.

Conduct service without business tax obligations - offshore company formation. Tax places, such as British Virgin Islands, allow the formation of International Business that have no tax Click Here obligation or reporting responsibilities. This indicates you conserve cash not just from the absence of corporate tax obligations, however additionally from other regulatory costs. Enable work or working as a consultant fees to gather in a reduced tax obligation area.

The Buzz on Offshore Company Formation

This enables the charges to accumulate in a low tax jurisdiction. International Companies have the same rights as a specific person and also can make financial investments, deal realty, profession portfolios of supplies and bonds, and conduct any legal organization tasks as long as these are not done in the nation of registration.